I will be talking about the recent interest rate hikes. How crazy is it that just the latest rate increase was a whopping .75%? But... is that actually good or bad? Have you done the math? I have, and I will let you know how does that look for us, awesome investors. But first, let me start with some observations.

It is finally happening, a broker that I have been downloading OMs from over the last few years has, for the first time, followed up on a deal with a phone call, and a one and a half minute voicemail. And he said that two months ago, I signed an NDA on a $12 million property for sale, that is now for sale at $9 million. That is a 25% discount in only two months. Simply put, they are getting less offers than before, these deals are taking a lot longer to close, interest rates are going up, cap rates are going up. The time is finally coming where you can find deals with value add and actually have some room to breathe, buy a lot of properties, as many as you can, and add value.

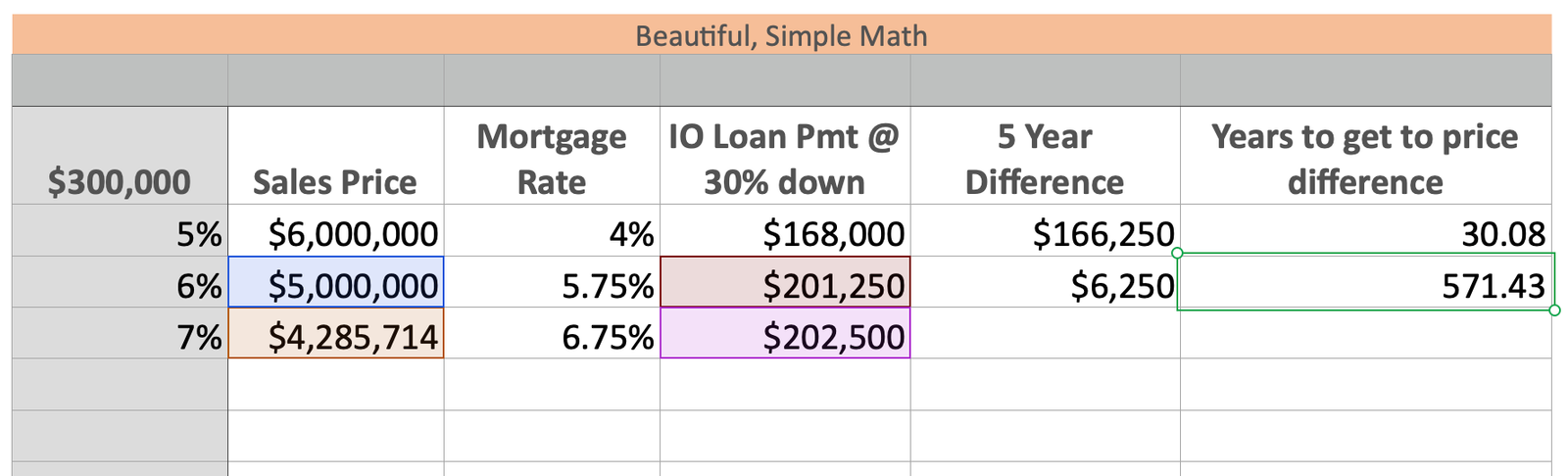

One super important thing that I want to talk about that I haven't heard anyone talk about yet is the fact that obviously, interest rates are going up, Oh, how terrible is going to be, a 6.5% interest rate after this latest increase on July 25th 2022. Some people are saying it's going to be in the eights by the end of this year. And guess what? I literally don't care. I did all the calculations and wanted to share it with you so that you understand that having high interest rates really do not matter. The cap rates go up as interest rates go up. I'll start by sharing some calculations that I did. Let's say you have a property that has a $300,000 NOI (net operating income) per year. And up until the beginning of this year, cap rates were for this kind of property were at around 5%. So the sales price for this property would be $6 million in January of 2022, and at that time, the interest rates were at about 4%. So we're going to do a calculation here at a 30% downpayment on a $6 million property at a beautiful interest rate of 4%. Your loan is going to be $4.2 million, and to keep things simple, we're going to do an interest only calculation, so $4.2 million at 4% interest only is $168,000 payment per year. That's a beautiful interest rate. That's a high price.

Today, we're getting a higher interest rate, and because of that the cap rates are going up. So that means that the price for these properties are starting to go down. It's pure math, unless people are buying this with 100% cash, they need to get a loan and the loan is directly tied with a debt service coverage ratio. The debt service coverage ratio for those of you who may not know exactly what that is, is the ratio of cash available after expenses to service the debt, in other words, it is the ratio of how much net operating income you have to make your mortgage payments. So this should be around 1.2 to 1.3 debt service coverage ratio, that's what the banks look for. And in order for people to be able to stay at that 1.2 to 1.3 debt service coverage ratio, the price has to go down on these properties. So now, let's look at a mortgage rate of 5.75%, which is more or less what is happening today. Tomorrow, it's probably going to be 6.5%, but who knows, I'm just giving you some numbers to play with so that you understand that nothing really matters because the cap rate is going up, therefore, you're getting a discount on the price of the property. Therefore your mortgage payment is basically the same with the interest rates going up, and also with a property prices going down.

Let's move this $300,000 NOI property to a 6% cap rate, and depending on the asset class, you may be a little bit higher, you may be a little bit lower right now, but we're going to average this cap rate at 6%. So at 6%, the sales price is going to be $5 million, you just got a $1 million discount because the interest rates went up. Now, I'm calculating from 4% interest rates to almost 2% more at 5.75%. The interest only payment with 30% down on a $5 million property is $201,250. Now, think about it, you are paying $168,000 a year at a 4% interest rate, and now you're paying $200,000. With this higher interest rate, as well as shaving off a million dollars, the price difference on your mortgage payment is an additional $33,250 per year. But let's not forget, we got a discount of a million dollars. To put it simply, you're going to be paying $33,000 more per year, and you got a $1 million discount! So let's calculate $1 million divided by $33,000, guess how many years is going to take for you to start being on the red? 30 years, it's going to take 30 years for you to get to that $1 million discount you got. I hope this makes sense because this is completely mind boggling.

If you're worried about the high interest rates, you should actually be celebrating and opening all your fancy champagnes because this is going to be party time. Not only that, these rates are going to come down in five years, you just saved a million dollars this year, and let's say you're paying that that $30k more for five years. That's $150,000 that you paid to get that million dollar discount! How beautiful is that? I really hope you understand this math because it is so exciting. Now let's divide that $700,000 discount by $1,250, that is 572 years! That's how long it's going to take to make up the difference in the higher interest rate and the discount you got on the property compared to the 6% cap rate at a 5.75% interest rate.

Lastly, let's look at a difference between a 5% cap and a 7% cap rate and a mortgage rate of 4% to 6.75%, which is almost doubling the interest rates. At a 5% cap, your purchase price is $6 million dollars, at a 7% cap, your purchase price is $4.285 million, that is a $1.715 million difference, and a 2% cap rate increase. And let's not forget your downpayment is also going to be less, it's going to be almost $700,000 less, your downpayment is going to be going from $2 million to $1.285 million. That means that we also need to think about the time value of that money that you don't have to put down and you can use to buy another property. There are so many directions that this calculation can go into that it's mind blowing. Let's go from a 5% cap and $6 million purchase price to a 7% cap at a $4.285 million price, the mortgage rate of 4% is going to a 6.75% mortgage rate. You are going from $168,000 interest only payments per year to $202,500, a difference of $34,500 per year.

You're paying $34.5k more per year with this higher interest rate, even though your sales price is almost $2 million less, so now, we're going to divide that by the difference in the sales price. As we said the difference is $1.715 million, that's the discount you got, but you're paying $34.5k more every year. Guess how many years that will take for you to start to be on the red, or however you want to word this? 50 years, it will take 50 years for you to get to this $1.75 million difference at this higher interest rate, and that is if these rates stay this high for the next fifty years! Give me a high interest rate all day long. Don't let it go down for a while, because once you start buying properties at high interest rates at this incredible discount, you're going to be able to refinance them five years from now, when interest rates start to go back down again. And you're going to be more than positive compared to all of these people that bought at a 4% interest rate over the last several years.

I would be fascinated to see how these numbers work as a strategy to buy properties only once a decade, I heard that there's a very successful investor in the Bay Area that only buys properties once a decade, during these times. And I am super curious how that would look like in terms of money last because you didn't buy in 2016 up until 2022, versus all of the discounts this person gets from 2022 all the way to let's say 2024, 2025. Real estate is all about math. And it's stunning how these high interest rates are going to benefit all of us. All of you that have been learning this entire time and you felt a little bit down because you weren't able to find deals, the time has finally came, and it is going to be here, for at least a couple of years, maybe even more. May interest rates keep going up so we can get even more beautiful deals.

Steffany Boldrini

linkedin.com/in/steffbold