What should you include in your pro-forma when doing a real estate development? Renat Yusufov, Managing Partner at Bullpen shares his detailed pro-forma, how should you think about it, and why.

Watch this deep dive here: www.youtu.be/TfJUcVGVCbQ

Tell us a little bit about you and Bullpen.

I'm based in New York and worked in several capacities across real estate on the private equity side, asset management side, as well as on the capital markets advisory side. Somewhere around 2018, I met my partner Tyler Kastelberg, who was at that point, starting Bullpen. The strategy really aligned between us two, both of us had real estate investment experience, and we both ran into the same problem both as an employee and an employer in the industry, we found that a lot of talent is frankly misplaced. And what that does is a lot of employers end up not being able to find the right talent for the project. And a lot of the employed professionals end up being in capacities or in jobs that don't necessarily fit their career goals. Real estate itself is a project based business. So it's not something you necessarily need to be doing the same thing every day. Most investment funds will probably do a few deals a year. In today's environment, large or small, you're probably looking for a specific team even if you're at Blackstone, you're doing what like four to eight deals a year, depending on the kind of deals you do. Most investors do less than that. Any kind of mid sized private equity fund today is probably doing anywhere between two to four deals ideally.

With that in mind, we realized that if you're looking for higher end professionals, or any kind of talent that has experience in what you're looking into, you're probably not interested in paying the full salary, medical benefits and any other kind of payroll costs to have somebody staff full time if you're only going to be using them for two projects a year. Both Tyler and I have been running into this issue professionally on both sides of the table. And this is how the concept of Bullpen came about. Bullpen is a freelance marketplace, where experienced talent, our average is about 10 years plus in terms of experience, are able to be connected with employers who are willing to hire on a project basis, whether that's on an hourly basis, on a monthly basis or any other kind of an enterprise solution that an employer would be looking for. The services and the skill sets range pretty widely. We started with the bread and butter of financial analysis and investment analysis, and now anything from web creation, marketing, investor relations, asset management, and any other facet of real estate.

This is a much needed type of service, at least for me when I came across a potential project in San Francisco to convert retail to office. And that's how I came across you guys because there are a billion moving parts, especially when you're planning on developing and building a few more floors. Why don't we dive into an example of what you guys are doing for this particular side of the business.

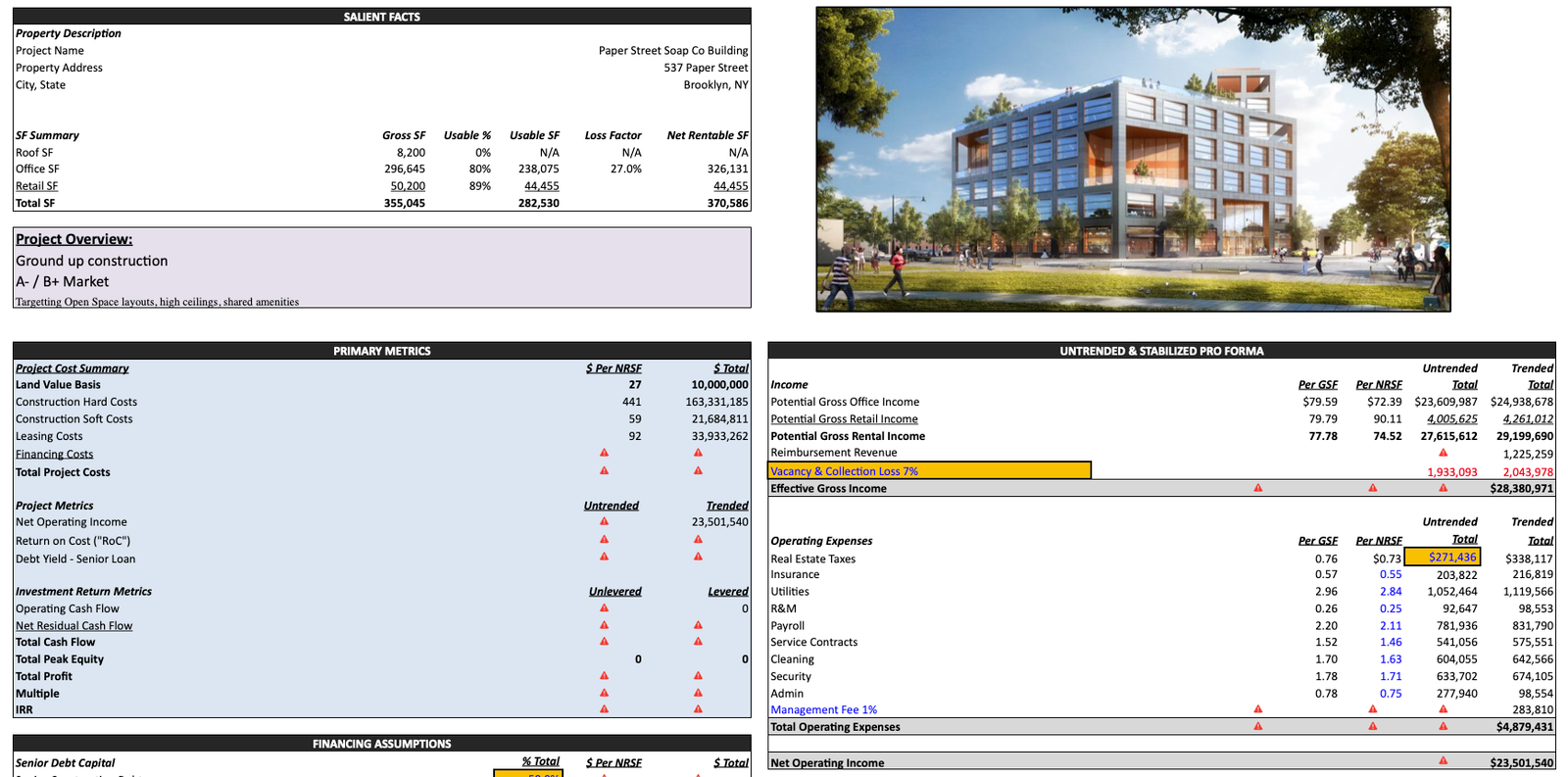

I created a template so to speak for an office development of what it would look like in today's day and age, I come from the philosophy that no two deals are ever going to be the same. Naturally, you will have certain changes. But the core of the model should more or less look alike, it's not just a financial model, it's really a weapon for when you go into battle for a project. So it should be flexible, it should be something that you can present relatively simply to either your lender or any kind of investors or limited partners, etc. It should be able to adapt to whoever your audience is, the structure of a model, in my opinion, regardless of what asset class, regardless of what the business plan is, I like to always start with the dashboard. The dashboard is really where most of the toggles will be, anything that's an input. And the reason for this is as you're going through the project, regardless of where the onset underwriting starts, along the way as you're talking to GC's, as you're talking to other contractors, architects, lenders, investors, business plans will be adjusted, they will be tweaked, they might be entirely revised, so it's easier for any kind of user, whether it's the partner, the principal, all the way down to the analyst, and company, or even if it's a third party looking at this, to be able to see it all in one place, which I call the dashboard or the Summary tab.

The three big items that go into this are any kind of capital assumptions. This includes any kind of loans, you may have construction loans, perm loans, any kind of recapitalizations, refinancings, as well as anything that happens on the equity side. Any kind of splits you may have between the general partner and limited partner, if you have a co-GP and a sponsor, and they're in the waterfall, having it here means you don't always have to go through the entire end of the model every time you want to update something.

The second item usually ends up being its own tab, the budget. The start of the budget and the beginning of the project is usually ballpark, sometimes you're going to do this as dollars per foot on hard costs, soft costs, many kind of architectural costs, etc. Chances are as you're moving through the project, especially for development projects, as more and more parties look at it, GC's, architects, any other kind of designers, etc, you're probably going to have a little more detail built out into line items. I like to create a budget usually with additional rows, or in a way where the formula for the sums or the subtotals, calculates in a way that you can always add an extra row if you need it, but this can get complicated, obviously, the only choice of preference is, are you looking at things on a dollar per foot for certain line items? Or if it's a fixed cost? Regardless of how big you build it, it's really dealer's choice when it comes to that.

And the third big bucket of assumptions is the operating assumptions. This is your expected revenues, expected expenses and anything else in terms of trends, inflation trends, how fast you're going to grow your revenue. In the case of an office development, what are your tenant improvement costs? What are your leasing commissions, and will it be involved in terms of your monthly or annual operation for the pro-forma. These are your inputs. And then below that, these are what I call supporting and receiving to the dashboard, this is really the engine, everything here is automated, theoretically, somebody who is a high level user doesn't ever need to go into these rows, they never need to go into these tabs. You just have to trust that it happens correctly. Outside of that, anything beyond monthly cash flows onwards, in terms of my model, is all automated.

The funding schedule is really the main engine, it's all the money that goes in, all the money that goes out on a monthly basis, the numbers themselves aren't really important. Starting with month zero all the way through the construction, the lease up, etc, all the associated costs, all the associated leasing and financing, all the money that goes to fund it, to match it, and then all the operating cash flows that go into it. This is all really an engine, and it pulls from the Summary tab. The same thing goes for the source and uses, the same thing goes for any kind of monthly or annual cash flows. That's as far as the bones of the model, I always think this is the best way to build it. You're going to end up having to do something in terms of flexibility, things always change as we know in the real world. I don't think I've ever worked on a project where whatever was in the original pro-forma, was the business plan that ended up getting done, things change pretty rapidly, especially in today's environment. The goal is to build it where you can quickly tweak it.

One place where a lot of things might be hidden or misinterpreted, is any kind of capital expenses. People underestimate what it costs to repair or repaint the hallway, or common space in an office building, if they're buying it already built. The best way to go about this, whether you're just in the beginning of building your model, or you're trying to flesh out your business plan and get it to market, I would say is contact as many professional as possible. This is obviously a networking business, talk to the brokers about the rents, what can they reasonably achieve, as you're going through your process of selecting a broker, talk to several GC's about your costs, what they can reasonably get you as far as a budget, and where you could reasonably land in terms of your total construction costs.

One thing about that, as we all know, this year has been crazy, especially with regards to wood and metal's skyrocketing costs. It really does a number on anything that has been underwritten on Q4 of last year, Q1 of this year, and they're just now beginning construction, they just got all their permits, etc, and the budget is 40% higher. It's no one's fault, nobody maliciously decided to increase costs, you just never know, the goal from the underwriting, or the model point of view is, this is your weapon, you want it to be adaptable, and as soon as you find out we adjust the construction costs, and then look at the returns, what it does to them, if that is an output. I guess that was a very long answer to the question about where does the beginning business plan start? I would say you most likely will see it to be more aggressive than usual.

I would have imagined that. I'm curious to see how you account for that on your model.

My viewpoint is whichever role you play on a project, let's say somebody first presents this to you. And you want to take a deal. Let's say you're an investor, a limited partner. Someone says, I have a great deal for you. I just need X amount of dollars. You take a look at this, right? And they say, Okay, these look like great construction returns, as you can see over here. This is project level unlevered and levered. For construction, 30% IRR is probably a great deal in today's environment. Is it true? If I'm an investor, I don't want to go through all these tabs. I don't necessarily want to go through the Argus, I look at summaries, the untrended stabilized performance financing assumptions for the construction loan, the total sources and use of all the money that goes in, and all the associated costs, construction costs, everything is summed up here, so I can go through this and look at this.

Now, do I believe these rents, for example, $70/foot? It could be yes, it can be a no. If I've experienced with any kind of management of offices, I looked at the expenses, regardless of what you're building, dollar per foot tends to be on a net square foot basis, it tends to be a pretty consistent metric. As you can see, this specific business plan is for one of those nice office buildings built in this environment, with co use of amenities, larger floor layout, so they can be a little more flexible in terms of partitioning for multiple tenants. You would go through what numbers you do believe or don't believe. I from my experience of doing any kind of deals, lean on experts a lot, whatever I think I know about rents I will inevitably go through a process of talking to multiple brokers personally, that's my favorite part of this business, my phone battery dies maybe three or four times a day. Maybe I just have an old phone but it a the fact that I'm on a call pretty much all day with contractors, brokers, just trying to figure out where the market is on any specific deal. Because every deal is custom, but it's the fun part of the business. You're always learning, always hearing new things. And you shouldn't be expected to know everything yourself as far as these numbers.

So, to answer your question, I would go row by row what I believe, but I would be more interested in the deal if it was presented to me this way. If not, I'm probably going to have to spend four hours looking through this whole model to learn it. This is more of a here's my rents, here's my expenses, here's where the loan is underwritten, do I believe this rate? Do I believe this leverage, etc. The more experience you have, the quicker you can get through something like this, but at least it's all on a single page that you can even print if you need to take it on the go.

Let's say that I am the sponsor on this deal, I'm trying to present it to investors as well as construction lenders, I would rather be more conservative on the on the first onset, inevitably you're negotiating and you're going to negotiate with the lender, and no matter what you present them, they will rein you in, that's their job, everyone will try to rein you in on everything they can, because everybody wants to outperform whatever is initially presented. So in order to really cut the part of how long it might take to negotiate and agree on any of these numbers, I tend to be a little more conservative on the underwriting. Beginning with the financing, construction, debt, it's a tricky conversation today, I don't know what it's like across the entire country. I'm relatively conservative to say that 50% of your total costs will be covered by debt, I think any lender out there who's currently lending will probably agree with that, and they'd be willing to look at a deal. If I go to any kind of lender and say, I need 75% of my total cost to be debt, either they will not look at the deal, or it'll be a lot more extensive conversation in terms of getting a deal with them. Similar with the rate it's split up in two, but essentially, this is 4.25%. Highly contentious subject, depending on the marketplace you're looking at today. If you're lucky, you might get below four these days for a construction loan. I think that's aggressive, that being said, it plays in terms of what other things are doing. If you're asking for high leverage at a low rate, you're probably not getting it. It's one or the other in some cases. And the second part of financing is on the equity side. And by the way, there's obviously things in between, to avoid complication, I didn't include it here, like anything regarding mezzanine debt on any type of preferred equity, etc. Anything else that goes in between would be included in this box for whoever's putting in money to look at.

The split here is 90% for the LP. And the remainder is funded by the GP. Within the GP, I usually like to split up, because there's usually more than one partner during the construction. There's a sponsor, and there's a developer, either they're providing you their balance sheet, so you can go get the construction loan, or any kind of other guarantee value, because most sponsors are at this point, treading pretty lightly. So it's nice to spread that risk and reward.

What is mezzanine debt?

Your senior loan in this case is a construction loan, which once you finish building it and you stabilize your product, you go to a permanent loan, which will be your mortgage. A mezzanine loan is more expensive debt, it's subordinate to construction, or to your primary loan. It usually comes from a private equity fund or any kind of equity bucket that is willing to have lower risk and lower returns than an equity investor. For example, if your loan here is at 50% loan to cost, so 50% of all your costs are covered by your senior loan. But that's for some reason that's not enough for you, you need more debt proceeds and can't necessarily fill that amount with equity, you just don't have the investors to fill up 50%. You would then find a mezzanine lender for let's say another 20%. That means that your debt is really 70%. Keep in mind, your mezzanine debt is probably going to be a higher rate than it would be for your senior, because they're subordinate, the higher up in the stack, their last dollars are more risky, but they're not as risky as the equity part. So they're somewhere between, but it's treated like a loan, it's just more expensive money, but not as expensive as equity.

Renat Yusufov

Bullpen

renat@bullpenre.com