Thanks for joining me! I’m excited to share all 34 pages of notes (and counting) that I have learned from my mentor, who has been doing retail real estate investing for over 20 years. A little bit about me: I have been living in Silicon Valley since 2000 and working in tech for the last few years. Being in the startup world, you definitely get enticed to become an angel investor in tech startups, and that is what I started doing – however – when I spoke extensively with my friend who has been in real estate for the last 20+ years, we came to the conclusion that real estate is the best form of investment, not only from a cashflow standpoint, but also from a tax perspective, and on top of it all, it’s a very secure investment: the worst thing that can happen is not making any money (versus losing tons of money as an angel investor). And if you are here, you already know all of that and need no convincing!

Now that you listened to my first podcast, let’s go straight to your to do’s, here is your homework for the day:

The first thing you’ll do as you are getting started in this journey of commercial real estate investing is to learn your market.

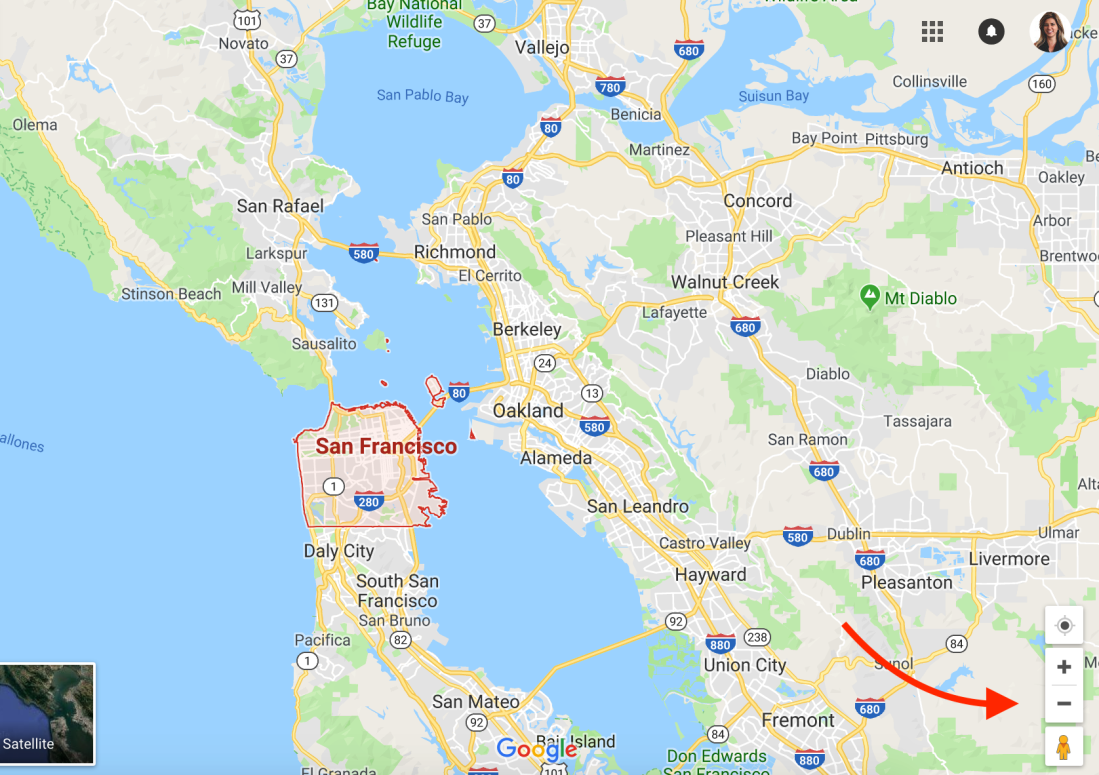

2. Type in your city, and zoom out to about 2 hrs from where you live. For example, for San Francisco, it should look like this:

3. Now open a new tab, go to

loopnet.com, search for the first city that shows on top of your google map, (in this example, I would type Novato on loopnet). Then click “alert” at the top right corner, and name this alert the name of that city (i.e. Novato) click Save. If this is your first time on Loopnet, they will ask you to create an account, in order for you to start saving your searches.

4. Continue to create alerts for all of the cities within 2 hours driving distance from you, in my example above, I’d go down on the map (San Rafael, Larkspur, Mill Valley, San Francisco, Daly City, South San Francisco, San Bruno, Pacifica, San Mateo, etc), then to the right (Richmond, El Cerrito, Berkeley, etc). Make sure you save each city as a separate alert, this will help you a ton when you start getting an email with all the new properties for sale in each city.

5. Now, you’ll start getting alerts in your inbox when properties come in the market. You should look at every property that comes in your market, so you can start understanding what the prices are in your area for all kinds of properties, what are the cap rates, what are the square footage of each property, what’s the net operating income of each property (NOI), etc.

6. Now that you’re all set with your alerts, go to

biggerpockets.com and create an account there, start reading their blog, and connecting with people around your area.

7. Feel free to connect with me on biggerpockets! I’m here:

Steph Bold

Nice job, that’s all for today, kids!

Subscribe to this podcast to continue learning the best commercial real estate investing tips and tricks from A-Z.

I’m excited to go in this journey with you.

Good company in a journey makes the way seem shorter. — Izaak Walton