What is the current state of the economy and real estate market? What are the opportunities and challenges in the commercial real estate market? Michael Ryan, an investor and loan broker with over 23 years of experience, shares his knowledge.

Tell us a little bit about yourself.

My main job is doing commercial and investor loans, and I have been involved for over 23 years. Back then, predating all the mass media and everything else, the constant topic was, “What’s going on? Why did the interest rates go up? Why did they go down? Or why aren’t they doing something?” The email newsletters I send out a couple of times a month now are just trying to share the consistent reading I do with investors so that they can look within and have a constructive and objective conversation around that.

Based on all of your readings so far, what is happening right now?

The two fundamentals for generating wealth in the US have not changed. It’s either small business and/or real estate, and the economy goes up and down. We are having a recession right now, but this will be my ninth walk around that mountain. I had the pleasure of being present for a few more recessions than the media has even reported. I purchased more properties during peak markets, knowing the markets were going to go down. It isn’t because I wanted to. It’s because, as an independent contractor in the mortgage business, my income is best at market peaks, and it tanks in the downturns, which are the best times to buy. But my tax returns don’t support it, so I have to figure out how to generate wealth through real estate and buy at market peaks.

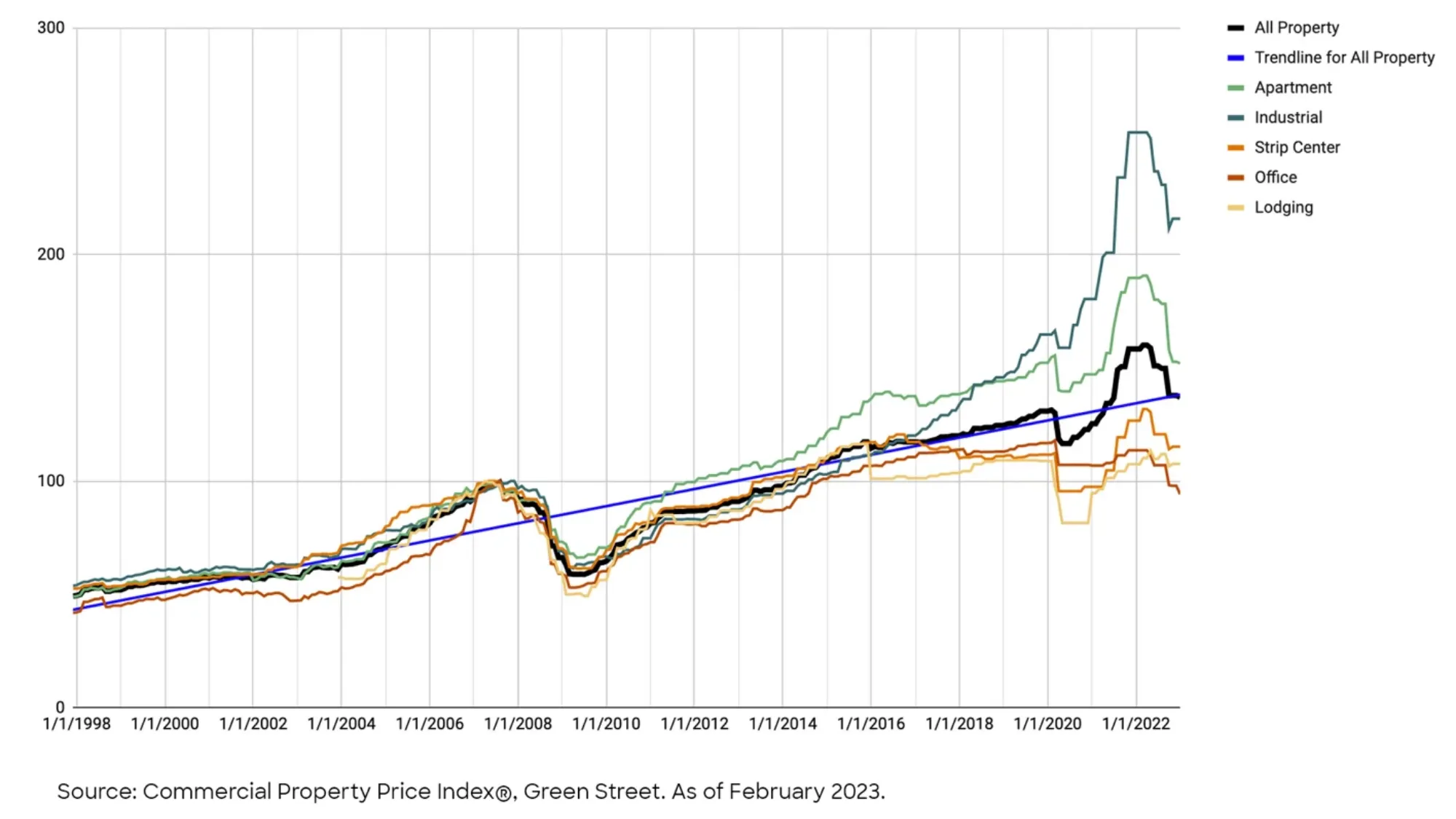

Real estate is the slowest and the most boring path to wealth, but if you hang on to a property for 20 years, the value is going to go up. We see the same thing with the equities market and the stock markets. Spin the wheel of fortune, pick a date, and roll 20 years forward. I have some property outside of Tampa, and they’re talking about how Tampa residential real estate stinks right now due to overbuilding and the influx of people moving to Florida slowing down. That’s the headline. When you’re coming off five years of massive growth, it makes sense to have a little cooling period. Apartment buildings might not be doing as well during the period, but does that mean that apartments are a bad investment? Let’s broaden that conversation to try to reduce the fear. After Phoenix goes up 25% a year for four years, do you want to buy in Phoenix? Maybe not in year five, but does that mean you’re going to ignore Phoenix for the next 37 years?

As far as a recession, I’ve always been in the “easy landing camp” just because of some of the other aspects going on. The job market is holding up because, until it tanks, which is a trailing indicator, we’re not hitting it. The bigger challenge we’re having is the two or three years of overcooked inflation. That’s what everybody’s fighting right now.

You mentioned that you were buying homes in 2008 or 2009. Can you elaborate on the math behind it because you knew it was going to go down? Did you compare that with the taxes you were going to have to pay versus the discount you would get in 2010-2011?

There are seven or nine states that have Prop 13, so I also bought properties in 2005. I knew the mortgage market was going to blow up with zero-down stated income. A few people listened, but most didn’t. All of my peers were buying wonderful, million-dollar houses up on the hills; I bought a duplex rehabber in Sunnyvale. During the downturn, I had rent from another house. I house hacked my place, so I had roommates. All of my friends lost their million-dollar homes, and I still had my duplex. Property taxes went down in 2009, 2010, and 2011. I chose an adjustable-rate mortgage to get through that period. I just sold the property last month for three times what I paid for. If it had been a single-family home, it would have been worth four times the original amount. But if it was a single-family, and I did not have the extra cash flow at the time, I would have lost the property at those peaks in the marketplace.

When I talk with my clients, I ask, “How are you going to weather downturns?” Most of my clients are well-positioned with the Fortune 5000 company that they work for, and they’re confident that they’re not going to be the ones to get laid off. That’s a completely different dynamic than our computer programmers in 2003-2005. They all became realtors and mortgage professionals because it was taking them an average of 24 months to find a job programming. That was one of those unnamed little recessions that didn’t hit the country, but it sure hit Silicon Valley.

Regarding the “soft landing happening in the jobs market,” I heard that they changed how they measure it. Is that correct?

I forget the acronym for the group that determines when we have a recession, but they never name a recession until we’ve had one nine months previously. I look at the numbers a little bit differently. We had a recession, and it was called COVID. We had two months of negative GDP growth, which historically is always the hallmark of a recession. And amazingly, the group didn’t call that a recession. COVID hurt many people and many businesses; it was a recession/depression. I call it one because of the technical merits. When you have a 10% unemployment rate, you are dancing between recession and depression. When you have 10 out of every 100 people not working, that math doesn’t work. And in every one of these downturns, they’re sectors that benefit in the equities markets. When you talk to good stock traders, they term these industries defensive stocks because they generally do better in downturns. Unfortunately, defensive stocks are in things like liquor, tobacco, and nail polish.

I like having those analogies because it’s about getting our clients to laugh with us while we’re talking with them. Laughter is important for a couple of reasons. Happiness is a better emotion to be making decisions from. When you’re laughing, you retain between one and a half to five times more information than when you’re crying.

Looking into the next year or two, what do you think people should be doing right now about commercial real estate investing?

What an incredible time to buy! I generally come across as being a contrarian. My joke du jour when I’m talking with people is that if you’re a Democrat, I’m going to play a Republican, and if you’re Republican, I’m going to play a Democrat. The reason is that you don’t need yes-folks around you. You need people who are going to work to broaden your thought process and challenge it. Then, you get a chance to sleep on it. When you come back, you can tell me what you want to do, and we will execute the plan.

Before the Fed meeting, when they lowered the rates, I put in my residential newsletter that the best time to buy was 90 days ago. When the interest rates were hitting 8%, it was the absolute best time to buy residential real estate in California. You had no competition, and the sellers were scared to death, so you were able to negotiate lower prices. We’re in Prop 13, and lower prices mean lower taxes forever. And when the interest rates drop, we’re well versed on what to do then. Now that the interest rates have gone back up, the commercial real estate cap rates are up. If you’re wondering, “Why is that happening?” It’s because now they’re not expecting the Fed to continue half-percent cuts because the news is out that maybe the economy isn’t as bad as mainstream media makes it out to be. The commercial real estate cap rates are up. Go back historically and look at cap rates to get a perspective. I still can’t figure out why San Francisco cap rates are still in the fours. That blows my mind. But I have clients currently in contract in Oakland, and we’re tapping seven/seven-and-a-quarter cap rates on apartment buildings. We’re doing agency loans.

When was the last time you heard 25% down on apartment buildings in California? It’s been a long time. One of my core areas is retail shopping centers. You know how everybody in COVID was saying, “Oh my god, shopping centers.” That turned out to be a great play for people that were in that space–maybe not the makeup places. But all your neighborhood shopping centers were doing well because people still had to go somewhere.

The commercial space has the challenge that the banks don’t know what to do. As for offices, I don’t have a good feeling about those. They are so specific, and we’re just now in coming back to work mode. I called that one a little bit too early. One of the first major companies requiring employees to go back to work was Zoom. I’ve been laughing about that one. The collaboration, the human dynamics, and humanity as a communal organization are important, so offices will come back. Apartments have become a nationwide problem with not enough growth. Although it is having a soft patch right now, its growth is waning. Permits and places under construction in 2025 are supposed to be about 25% of what we saw in 2024. But as long as people are working, we are going to be expanding households. Expanding households will mean we will need more retail, more apartments, and more commercial properties. Industrial spaces are finally starting to show a little bit of slowing. Infill projects, rather than the path of progress, will have lots of opportunities, except Silicon Valley.

Your expertise needs to be about being able to find those opportunities, being able to find whatever special sauce you can add because we do have a lot of aging properties. The aging is two-fold with the property physically aging and/or the ownership aging. That’s where being able to come in and clean up is beneficial. The high interest rates? It just requires more down payment, but it does not change the fundamentals of the property. What’s the trend going to be with every downturn? What’s the next turn of the wheel? If it’s an upturn. And then, we have to be careful because with the upturn, what is the next turn of the wheel? We don’t know until it hits. If you’re buying at a seven-cap rate, your exit strategy is improving the property, and you’re going to exit when the market cap rates are at a five, that’s your plan. Make a plan so that you’re able to utilize the trends.

Sometimes, we miss it by a few years, like my mentor, who has been waiting for the downturn since 2016, but it is what it is.

People that we know were in for repositioning properties in 2018 and 2019 with a five-year hold. Then, they got crazy offers after two years and had enough smarts to take the deals. They knew that pigs get fed and hogs get slaughtered. They were on the piggy side of the line while they took the money and ran. You can plan for something, but you have to have the horsepower to get there. Sometimes, a five-year plan turns into eight. You have to be able to have those conversations with the investors and not have the investors get upset if plans need to change.

Michael Ryan

mike@michael-ryan.com