What's the state of commercial real estate in San Francisco, California? I will be giving you my personal insights of what I have seen happen to the city and what I think has led the city to its current demise.

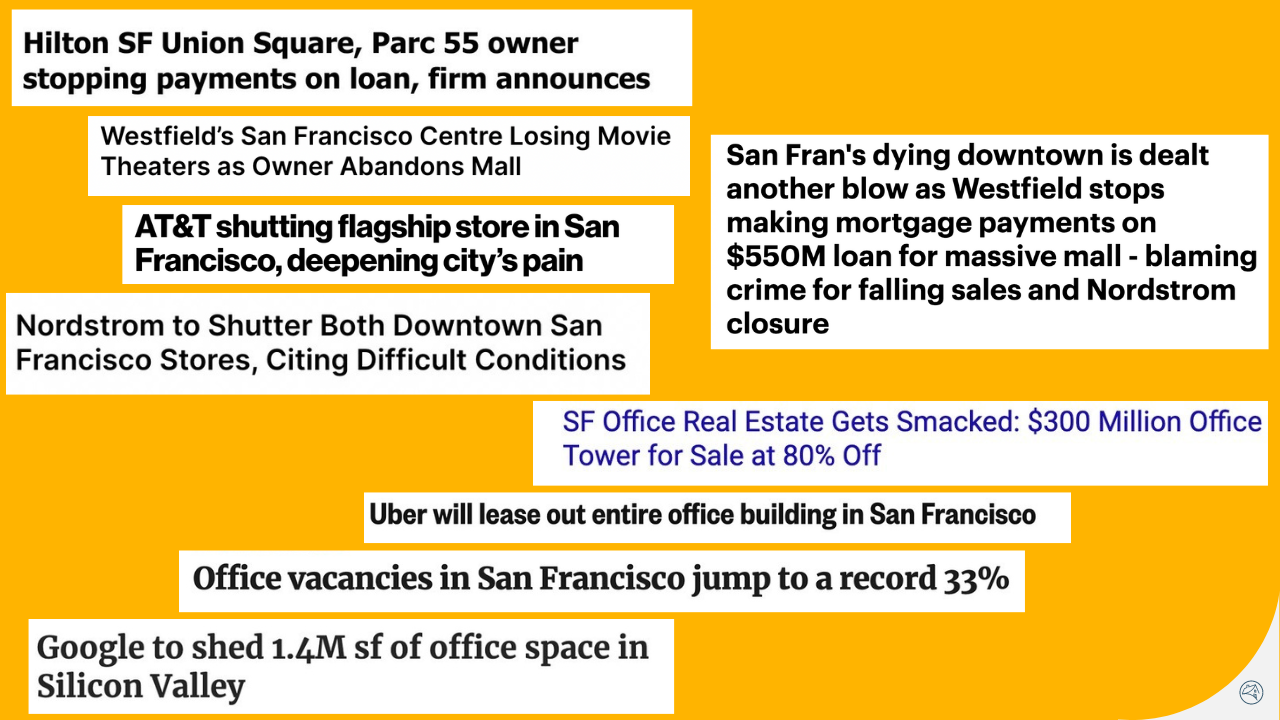

I'll start with the headlines that are making the news. Note that all of these headlines came out in the last one month!

1. A San Francisco office building that was worth $300 million pre-pandemic is now in contract for around $60 million. And that is between 200 to 225/sf. The building next door at 550 California St is reportedly in contracts for $130 a square foot. Lastly, a friend of mine put an offer in an office building about a month ago, her offer was $75 a square foot and although she did not get the building, she ended up going to the second round, which means that people are considering $75/sf offers. Let that sink in for a bit! Rent was getting close to $100/sf per year. And now you are able to buy an entire office building for between 1.5-2 years worth of rent pre-pandemic.

Where did things start to go wrong? The first red flag is that we currently have a 33% official office vacancy. The actual number is probably around 50 to 60% because the "official" vacancy rate is actual vacant space that is up for lease. The actual vacancy is a different number that I think is close to double of what it is because there are companies that still have a lease and they have office spaces that are actually vacant. They have a lease and that space is up in the sublease market and that does not get counted on the official vacancy number. I think the reality is between 50 and 60% actual vacancy, it could be more, it could be less. To give you a perspective. Vacancy rates pre-pandemic were at an all time low of around 5%. So going from five to 33% is an increase that nobody would have ever imagined or predicted. It's not a 100% increase, or 200, or 300. It's between a 600-700% increase.

2. Uber announced that they will be leasing out their entire office building in San Francisco.

3. Google announced that they will be shedding 1.4 million square feet of office space in Silicon Valley. As we all know commercial loans are 3, 5 or 7 year fixed, a lot of them are coming up and they have to refinance at not only double the interest rates, but also they have to refinance when their office building is completely vacant - and nobody will give you financing for that. Operators are returning the keys to the bank, or they are having fire sales which is what happened with this 350 California Street building.

4. Nordstrom is closing both of its Stores in downtown San Francisco, citing the changing dynamics of the area that hasn't recovered since the pandemic and has been in the spotlight for crime.

5. AT&T just announced that they're closing its flagship store, citing declining customer visits, occupancy and sales.

6. Cinemark also just decided to permanently close the Century San Francisco Centre 9 and XD theater following a review of local business conditions.

7. Whole Foods in Downtown San Francisco Closing a Year After Opening due to safety issues.

8. Several Other Major Retailer closures since the pandemic: Saks Off Fifth, Anthropologie, Office Depot, Amazon Go, The Real Real, CB2, Banana Republic, Athleta, The Container Store, Crate and Barrel, Disney, Marshalls, H&M, The Gap. Imagine how many hundreds of 1,000s if not millions of square feet will be available for rent right now in the retail space alone in this city? But who would want to open anything when criminals can steal what they want, technically up to $950. There are homeless tents in many of these major streets. These people are on drugs, a lot of the times shooting themselves up with needles. Sometimes you're stepping on needles yourself, sometimes they're defecating or urinating right in front of you. Sometimes they come screaming at you. Why and who would want to take up that space for rent and who would even be successful there to begin with?

9. Westfield Mall announces that they are returning the keys to the bank, they have been operating in the San Francisco center for over two decades. They are attributing this decision to the challenging operating conditions in downtown San Francisco, which have led to decline in sales, occupancy, and foot traffic.

No matter how much one wants to revitalize or repurpose that area, you must first deal with putting people in jail when they commit crimes because no retailer with half a brain cell will open up a store knowing that they're going to be losing money due to theft, because the criminals know that they are not going to get prosecuted. That is the biggest thing that the city must change right now.

Along with that is cleaning up the homeless people and putting them in institutions or wherever they belong, where they will get help and where they will have job opportunities. It's not rezoning, which the mayor just announced that they're going to be more lenient on what the usage could be for these office and retail locations. It is really taking care of the place so that people come back to this city.

11. Huntington Hotel and Yotel were recently sold in foreclosure auctions. This is not only because San Francisco took a very long time to get out of the COVID mentality, but also, because of the crime and all of the issues with the homeless and everything else.

12. People don't want to have conferences in San Francisco anymore. Hotels are struggling.

To summarize all of these articles up and what is happening the city in four simple words: Go woke, go broke.

And at the end of the day, it's hard to explain everything at once, because there are so many things that the city has done wrong, which has already spread to other parts of the state such as Los Angeles. The gist of it is that law and order must be restored to the city and state. You cannot be giving free drugs to people, that doesn't help and they need to figure out what helps, that is not my job, we already pay a lot of taxes for the people to figure that out. However, when you really think about it, these people get hundreds of millions of dollars just to "deal with the drug and the homeless problem" in the cities. Of course, they will never want to get rid of their job. The city needs a complete and utter cleanup and revamp from the bottom up.

Now that we reviewed all of these headlines that literally happened in the last one month, imagine how many more headlines are coming for this city. It is heartbreaking for business owners, real estate investors, and law abiding, taxpaying citizens that live in that city, because not only are businesses going down under, but citizens are also leaving the city because there are many other issues with San Francisco that led to its current demise.

14. Cell phone usage data went down by almost 70%. And this accounts for not only the people that were there working, but also people that used to live there and moved somewhere else.

So what do I think when I see all of these things happening? To me, this is a once in a lifetime opportunity, because I believe that they are going to fix the city sooner or later. At this point in time, it is finally coming full circle to the politicians because not only are these issues extremely terrible to a city and they're getting headlines, but also the collection of property taxes has significantly decreased. Now that it is hurting their own pockets, they are (I think) going to start fixing it. In my opinion, this is a huge opportunity. This is not financial advice, you should consult experts. However, I personally think that it will be a fantastic time to buy in San Francisco. I think that the best date will be in about a year, because there's just a ton of square footage that still needs to be leased up. Also because companies are starting to ask their employees to come back to the office, Facebook just mandated three days in the office starting in September. Other companies like Salesforce have shared that the analysis shows that people in the office are more productive than when they are working from home. I am also seeing startups and venture capitalists sharing that people are indeed more productive in the office and that startups are asking employees to come back in person.

It's going to be a slow process for all of that to revive the city. I also asked two extremely successful people in real estate investing, and they think that even better prices will happen towards the end of this year (2023) and beginning of 2024.

Is it risky? Of course it is risky! It's a huge risk, however high risk, high reward, and in this case, high risk, even higher reward. Why? Let's say there is a chance to lose on this $60 million office. However, if it comes back up in the next, let's say five years, it will not only go back to the 300 million that it was worth before, I think it could potentially be back even higher than that. So someone may lose that 60 million, however, they can potentially make another 255M a few years from now. The risk here is of course, the purchase price, the property tax, insurance and maintenance expenses until brighter days arise. Put that in a scale.

I wouldn't worry about picking the perfect timing to buy because this is just like stocks, very few people purchase at the perfect exact timing or sell at the perfect exact timing. However, if you are on the positive, of course, that small percentage wouldn't make a huge difference compared to the upside that we could get.